On Monday, officials from the Biden administration disclosed the specifics of a fresh initiative aimed at forgiving student loan debt. This suggests that millions of Americans could begin experiencing debt relief as early as this autumn. The proposals, which were initially reported by CNN on Friday, are still in the process of being finalized.

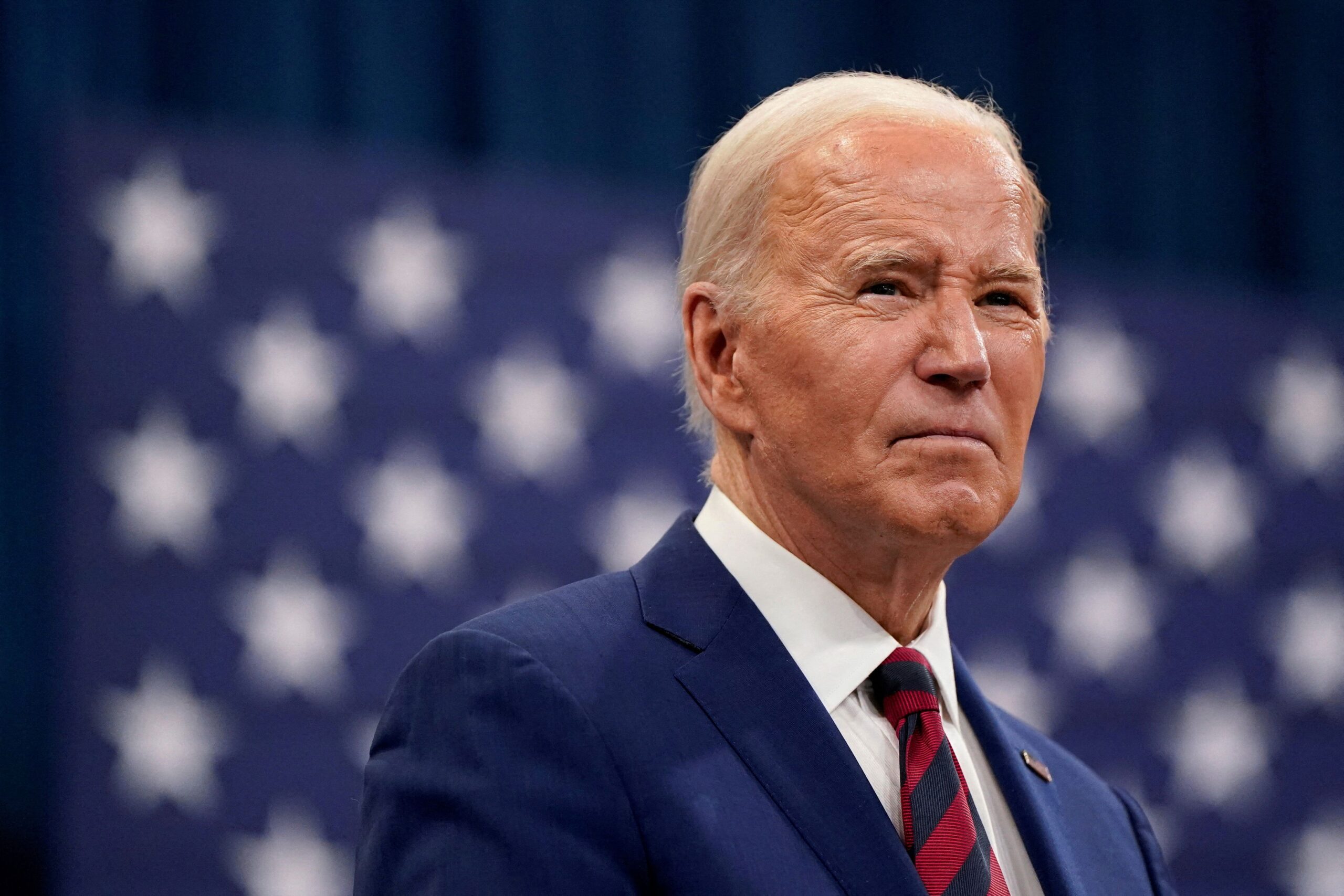

This marks President Joe Biden’s second attempt at implementing a comprehensive student loan forgiveness program, following the Supreme Court’s rejection of his initial plan last summer. The president is set to announce the plan in Wisconsin, a crucial swing state, on Monday.

Impact of the New Policies

When combined with the more targeted actions already taken by the Biden administration to cancel student debt, these new policies could benefit over 30 million Americans, as per a fact sheet provided by the White House. This implies that nearly 70% of all federal student loan borrowers could see their debt reduced or completely wiped out due to Biden’s policies. However, the plans must first be finalized, a process that could take several months, and must withstand any potential legal challenges.

Political Opposition

Biden’s new student loan forgiveness proposals could instigate another clash with Republicans. Several conservative-led states and groups previously sued the Biden administration over the first student forgiveness program, arguing that the executive branch had exceeded its authority. “President Biden will use every tool available to cancel student loan debt for as many borrowers as possible, no matter how many times Republican elected officials try to stand in his way,” stated White House press secretary Karine Jean-Pierre on a call with reporters on Sunday.

Pathway to Delivering Student Loan Debt Relief

Following the Supreme Court’s rejection of Biden’s first plan last year, the president pledged to explore another route to deliver student loan debt relief. Since then, the Department of Education has been conducting a formal and lengthy process, known as negotiated rulemaking, to develop a new student loan forgiveness program. This is a departure from the process used by the Biden administration in its first attempt to provide sweeping loan forgiveness, which would have canceled up to $20,000 in student loan debt for borrowers earning $125,000 or less a year.

Targeted Groups

The new plans aim to provide relief to specific groups of borrowers. If implemented as proposed, borrowers could see relief if they fall into any of the following categories:

Public Comment Period

The new proposals unveiled on Monday must still undergo a public comment period. After reviewing these comments, the Department of Education will publish a final version of the rule. Typically, if a final rule is published after going through negotiated rulemaking by November 1, it can take effect on July 1, 2025. However, exceptions are allowed, and parts of the rule could be implemented early.

Early Implementation

For instance, the Biden administration implemented parts of the SAVE Plan – an income-driven student loan repayment plan – last year, while other parts of the plan won’t take effect until July. In the case of the new student loan forgiveness proposals, the Department of Education could start canceling accrued interest for qualifying borrowers this fall, according to the White House.

Previous Achievements

Despite the Supreme Court’s rejection of Biden’s sweeping student loan forgiveness, his administration has still canceled more student loan debt than under any other president – primarily by utilizing existing programs. His administration has facilitated the process for certain groups of borrowers – such as public-sector workers, including teachers; disabled borrowers; and people who were defrauded by for-profit colleges – to qualify for student loan debt forgiveness. So far, 4 million people have seen their federal student debt canceled under Biden, totaling $146 billion.

This story has been updated with additional information.