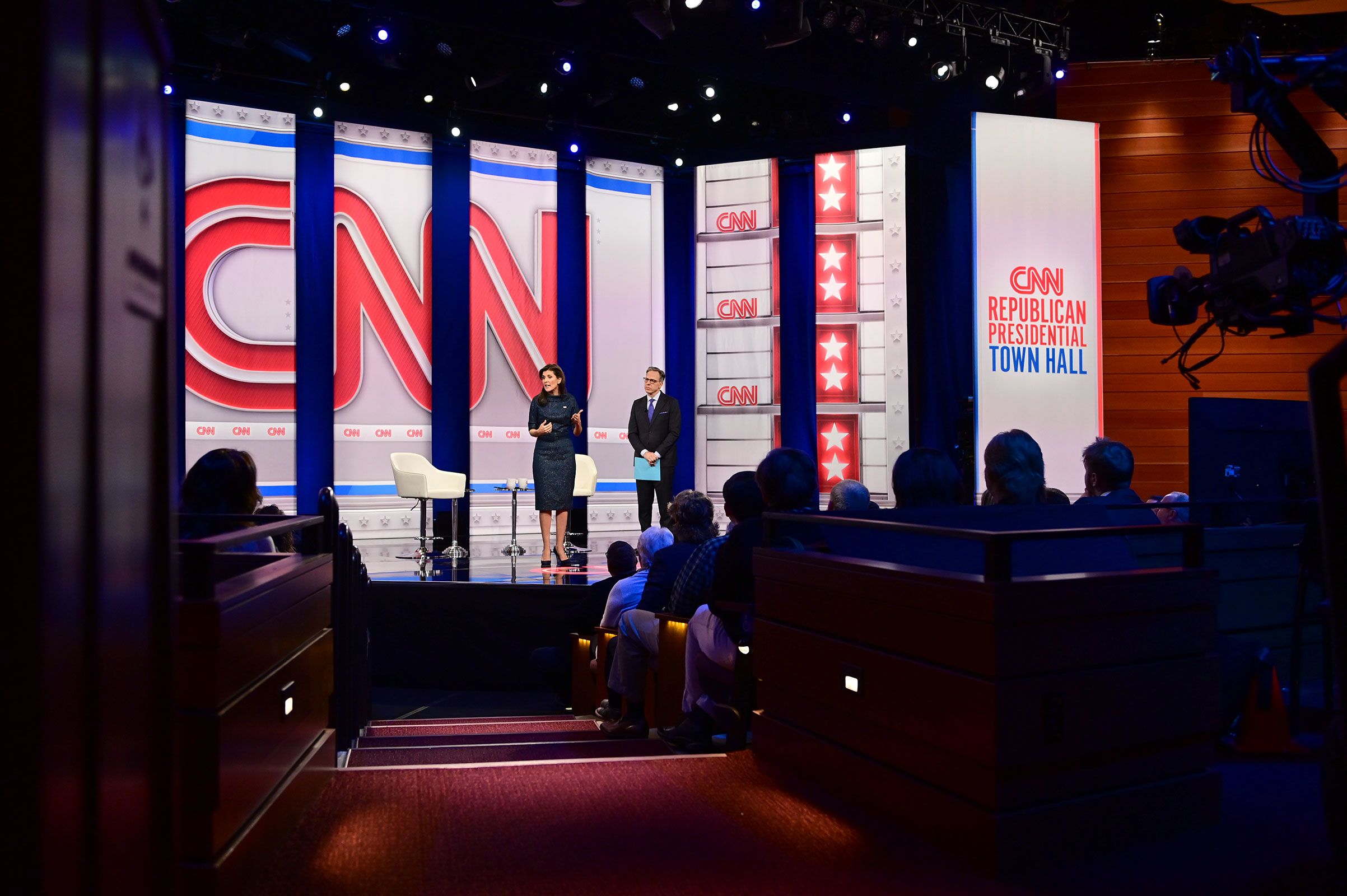

Ex-Governor of South Carolina, Nikki Haley, engaged in a CNN town hall in New Hampshire on Thursday, ahead of the state’s imminent primary. The Republican presidential hopeful, who finished third in Monday’s Iowa caucus, trailing former President Donald Trump and Governor Ron DeSantis, fielded a variety of questions from New Hampshire voters. This article fact-checks some of Haley’s assertions during the town hall.

Iran’s Attacks on US Soldiers

Haley claimed that it took Iran “shooting our men and women in Iraq and Syria … 130 times” for President Joe Biden to “do something” about it. However, this claim is inaccurate. The first US action against Iranian-backed forces occurred on October 26, following 19 attacks on US and coalition forces. This action involved an F-15 fighter jet and two F-16 fighters targeting weapons and ammunition storage facilities linked to Iranian-backed militias in eastern Syria. Since then, there have been several more strikes, with a total of at least 142 attacks on US and coalition forces since October 17.

Electric Vehicle Policies

Haley repeatedly portrayed Biden’s electric vehicle policies as mandatory, stating that the president’s goal is “everybody’s got to drive an electric car by 2033.” She added, “Americans don’t all want electric cars; quit telling them how to live.” However, this claim is misleading. While the Biden administration has aggressively promoted the shift towards electric vehicles, there is no mandate requiring their use. The administration’s policies include new tailpipe emissions regulations, tax credits for certain electric vehicles, investment in charging stations, and federal purchases of electric vehicles. However, there is no prohibition on the continued use of gasoline-powered vehicles.

Child Tax Credit

When asked about her stance on the recent bipartisan deal in Congress to expand the child tax credit, Haley expressed her support for a universal approach, stating, “If you’re gonna do tax credits, do it for everybody.” However, this misrepresents how the child tax credit operates. The credit is already available to a broad range of American families, with very low-income and very high-income households being the exceptions. The congressional deal aims to temporarily increase the maximum refundable credit for lower-income families. The proposed changes would benefit over 80% of the 19 million children who currently receive no credit or a partial one due to their families’ low income.