As the groundhog Punxsutawney Phil predicts an early spring, Americans are left to ponder whether the recent surge in job numbers will thaw their skepticism towards “Bidenomics”. Despite a general unease about the economy, a sentiment that has contributed to President Joe Biden’s low approval ratings, Americans continue to spend, bolstering key economic indicators.

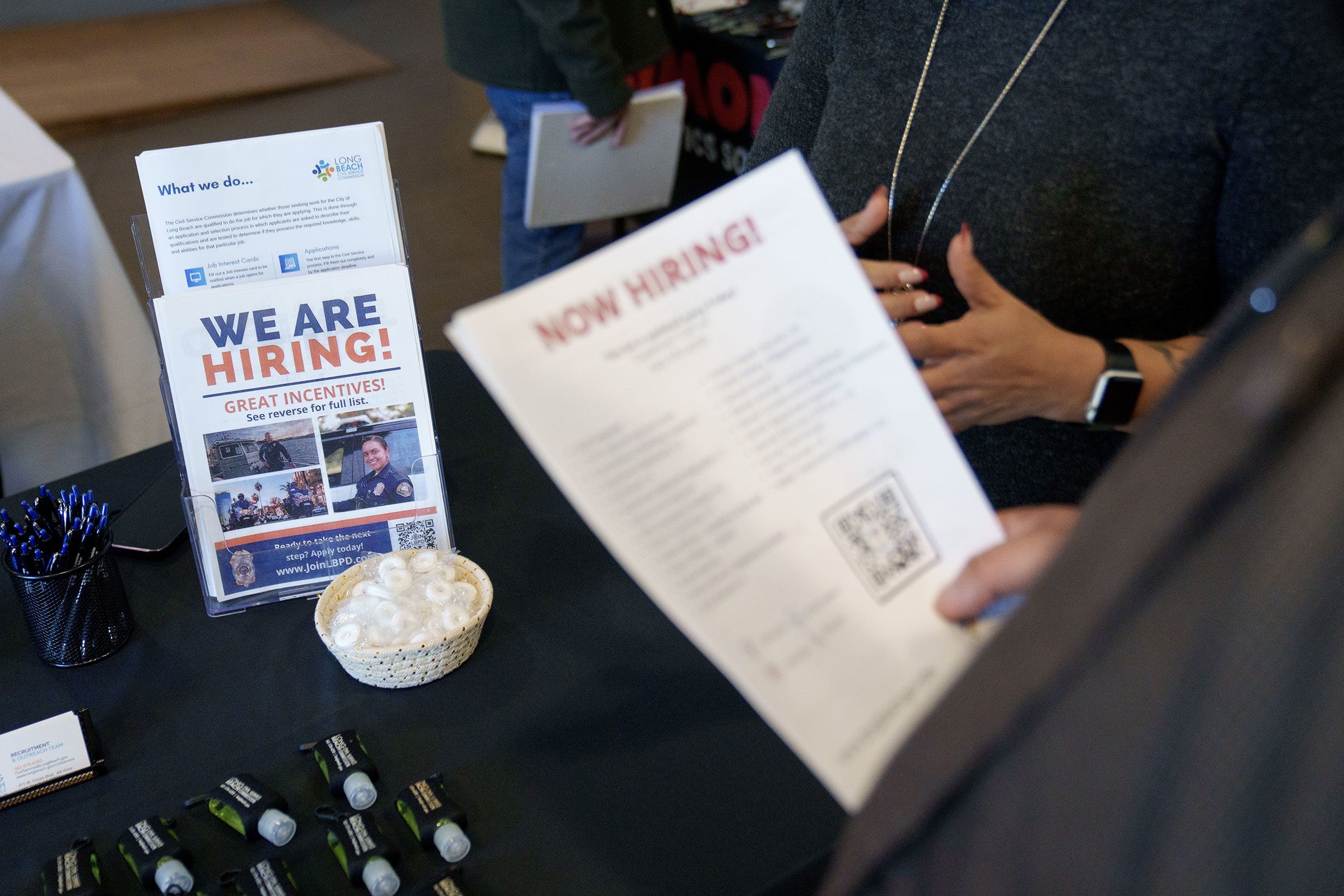

Impressive Job Growth Amid Economic Concerns

The Bureau of Labor Statistics reported a remarkable increase of 353,000 jobs in January, a figure that far exceeded economists’ predictions. The unemployment rate remains steady at 3.7%, marking two full years of sub-4% unemployment. Despite these positive indicators, public sentiment remains cautious due to ongoing concerns about inflation and the uncertainty of life in 2024.

Stock Market Success and the Blame Game

While the S&P 500 continues its record-breaking climb, benefiting many Americans’ 401(k) balances, the political arena remains divided. The upcoming general election, potentially a rematch between Biden and former President Donald Trump, presents voters with contrasting narratives. Biden’s camp touts the strength of the economy under his leadership, while Trump attributes the economic success to the anticipation of his potential return to office.

Interest Rates and Inflation

Despite conspiracy theories suggesting the Federal Reserve may cut rates to favor Biden, the Fed has maintained steady rates as inflation begins to cool. Investors and progressive senators alike are advocating for rate cuts to stimulate the real estate market and provide cheaper access to borrowed money. However, the Fed is cautious, aiming to ensure inflation is firmly under control before making any changes.

Economic Growth Amidst Rising Costs

Contrary to predictions of a post-pandemic recession, the economy experienced a robust year in 2023 and is projected to grow at an impressive 4.2% rate in the first quarter. However, this growth has not translated into lower costs for consumers, who continue to feel the pinch at the grocery store and other areas of expenditure.

Public Opinion: A Slow Thaw?

A recent CNN poll suggests that Biden has a significant task ahead in shifting public perception of the economy. However, there are signs of a positive shift in public sentiment. If job growth remains strong and inflation continues to fall, Biden may find it easier to convince voters of his economic competence.

The Ongoing Affordability Crisis

The Fed’s efforts to control inflation have been met with growing frustration. Democratic senators, including Elizabeth Warren, have expressed concern over the impact of high mortgage rates on housing affordability. Their concerns highlight the varied experiences of the economy, with sectors like tech experiencing layoffs and everyday items like eggs still seeming more expensive than before.